About Trans-World

Trans-World Compliance Inc., (“TWC”) provides cloud based software solutions to simplify the compliance and regulatory requirements for US, Foreign Financial Institutions, tax regulatory bodies and governments.

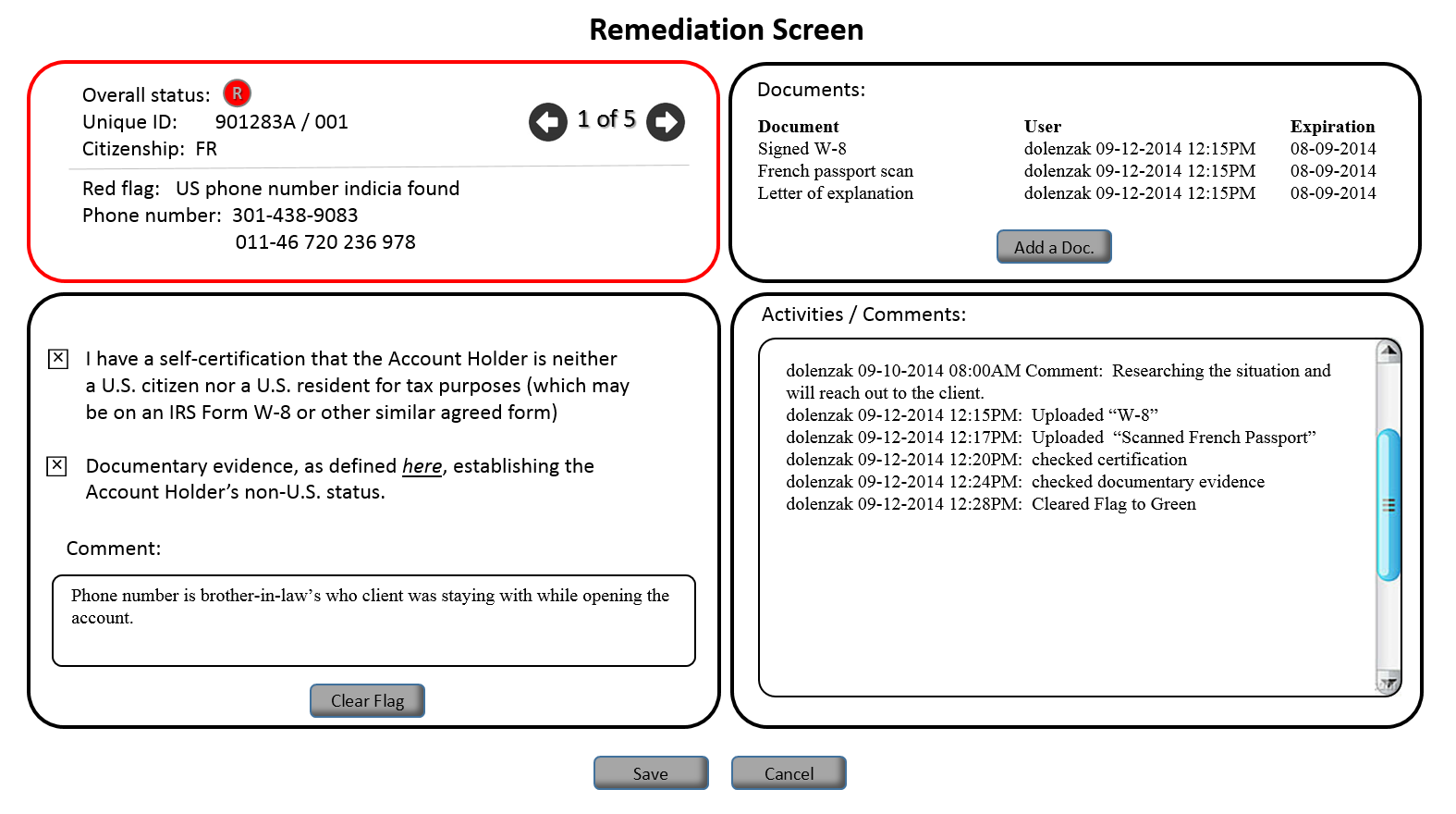

TWC saves time, lowers overheads and improves accuracy for compliance with international regulatory tax regulations and mandates by centralizing data, raising flags, tracking remediation, automated reporting, and providing an independent 3rd party audit of policies and procedures.

Resources

-

Contact TWC

Contact TWC

Contact TWC to see our FATCA solutions can assist you and your team in your compliance needs. -

Resources

Resources

Check out our resource library including white papers on FATCA and data sheets on TWC solutions.

We self-certify compliance with

|

Quick Links |

Resources |

Contact

|

Join Us on Facebook |

Linked-In |

Follow TWC on Twitter @TransWorldCompliance |

Blog |

The GRC Solutions Company

The GRC Solutions Company

FATCA One™ implements a concept of Rule Bases. A Rule Base is based on reporting regulations to a specific jurisdiction, reporting jursidiction, and fiscal year. The Rule Base incorporates rules based on:

FATCA One™ implements a concept of Rule Bases. A Rule Base is based on reporting regulations to a specific jurisdiction, reporting jursidiction, and fiscal year. The Rule Base incorporates rules based on: